February 2024 CPI Report

We realized today that expansion as estimated by the Shopper Value File was 0.4 percent in February and 3.2 percent throughout the last year. Center expansion, which leaves out unstable food and energy costs to all the more likely parse expansion's basic pattern, was likewise 0.4 percent over the course of the month and 3.8 percent over the course of the past year.

In this blog, we take a gander at a couple of classes in the CPI report that drive the expansive file from the perspective of half year annualized changes. Since one month of information doesn't catch the hidden pattern, and year estimates underweight later developments, we favor utilizing half year changes to support the sign to-commotion proportion without losing opportune turns of events. On a 6-month premise, generally costs were up 3.2 percent and center costs were up 3.9 percent.

We separate center expansion into three parts: center merchandise, center administrations barring endlessly lodging, and afterward finish up the image with a brief glance at energy and food expansion.

Center merchandise: As post-pandemic stockpile chains have unsnarled, products expansion has altogether facilitated and was negative from June 2023 to January 2024. In February, center merchandise costs ticked up 0.1 percent; in any case, throughout recent months, costs have fallen in this classification by 1.5 percent. The figure shows how center merchandise costs shot up during the pandemic, posting twofold digit expansion, as solid interest for products slammed into obliged supply chains. As supply standardized and interest for products facilitated to some degree too, expansion strongly turned around course. Since center merchandise represent around 20% of the general CPI and about a fourth of the center, their inversion has been a significant wellspring of disinflation.

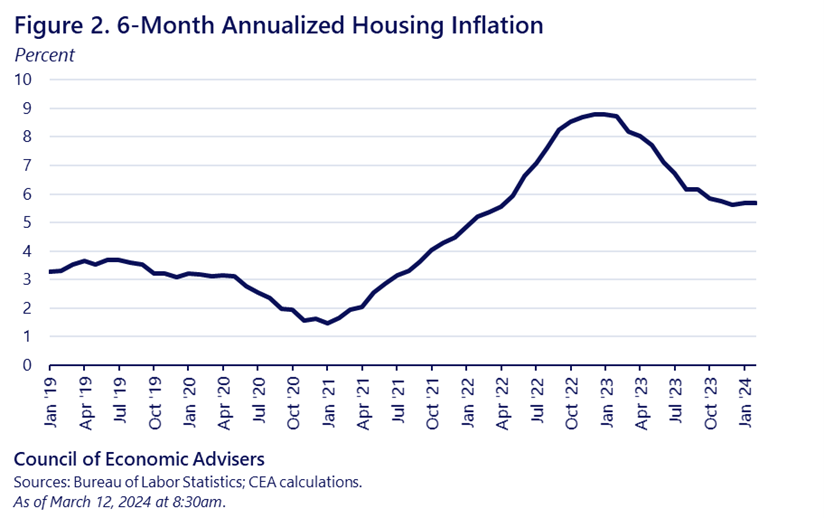

Lodging: Lodging is vigorously weighted in the CPI, representing over 33% of the absolute record and around 45% of the center file. On a 6-month premise, lodging expansion crested at very nearly 9% in January of last year, prior to switching course. The present report showed lodging costs up 0.4 percent last month, down from 0.5 percent in January. The figure shows that lodging expansion is altogether down from its pinnacle yet stays raised comparative with its pre-pandemic normal.

1

It is surely known that the U.S. real estate market experiences a drawn out supply deficit comparative with request. President Biden's FY 2025 financial plan, delivered yesterday, has an enormous and aggressive record of strategies to essentially support lodging moderateness — both for tenants and mortgage holders — and in particular, the load of reasonable lodging.

11

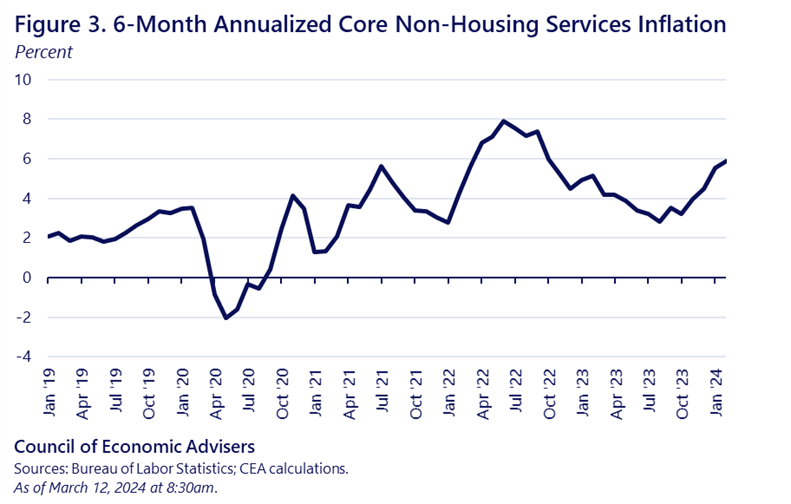

Last month NHS expansion was 0.5 percent, down from 0.8 percent in January. On a six-month premise, subsequent to tumbling from 8% in June 2022 to around 3% in August 2023, Figure 3 shows that the series has sped up and, in contrast to center products, is adding to higher expansion.

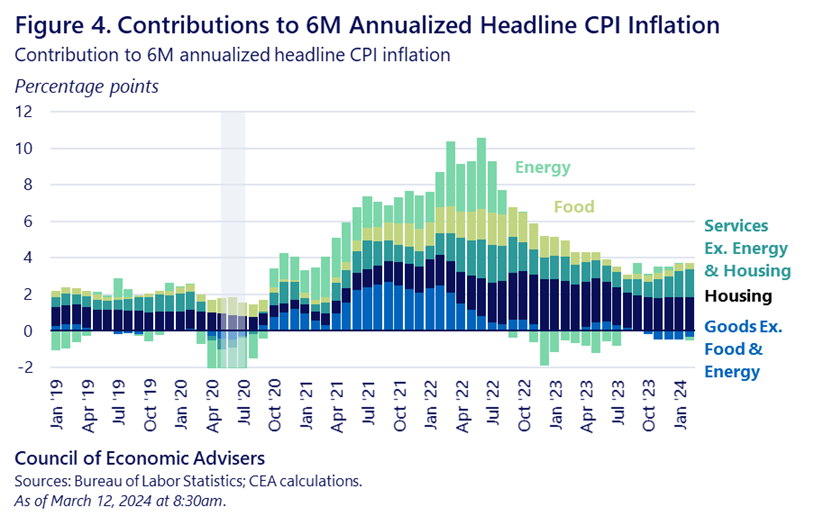

As noticed, these three classifications make up center expansion. To get to feature expansion, we really want to include food and energy. While energy overall and retail gas specifically has placed descending tension on the general file as of late, in February, the gas cost contributed 12 premise focuses to the month to month expansion rate, in the wake of taking away from month to month expansion over the earlier four months.

1

Food expansion has descended altogether for food and less so for cafés. Basic food item expansion was zero last month, contrasted with 0.4 percent in January. In February of 2022 and 2023, 6-month annualized staple expansion was 12.2 and 5.6 percent, separately. The similar figure in February 2024 was 1.6 percent. Throughout the last year, basic food item costs are down for pork, chicken, fish, eggs, milk, espresso, and margarine.

Figure 4 assembles this multitude of classifications, showing the commitment of each to the half year annualized development rate. The figure shows that food, products, and energy costs have contributed essentially to disinflation, while lodging and NHS expansion still can't seem to in every case do as such.

CEA will continue to get under the hood of inflation reports as the Biden-Harris Administration continues its work to lower costs on behalf of American consumers.

Comments

Post a Comment